Main media groups: an overview

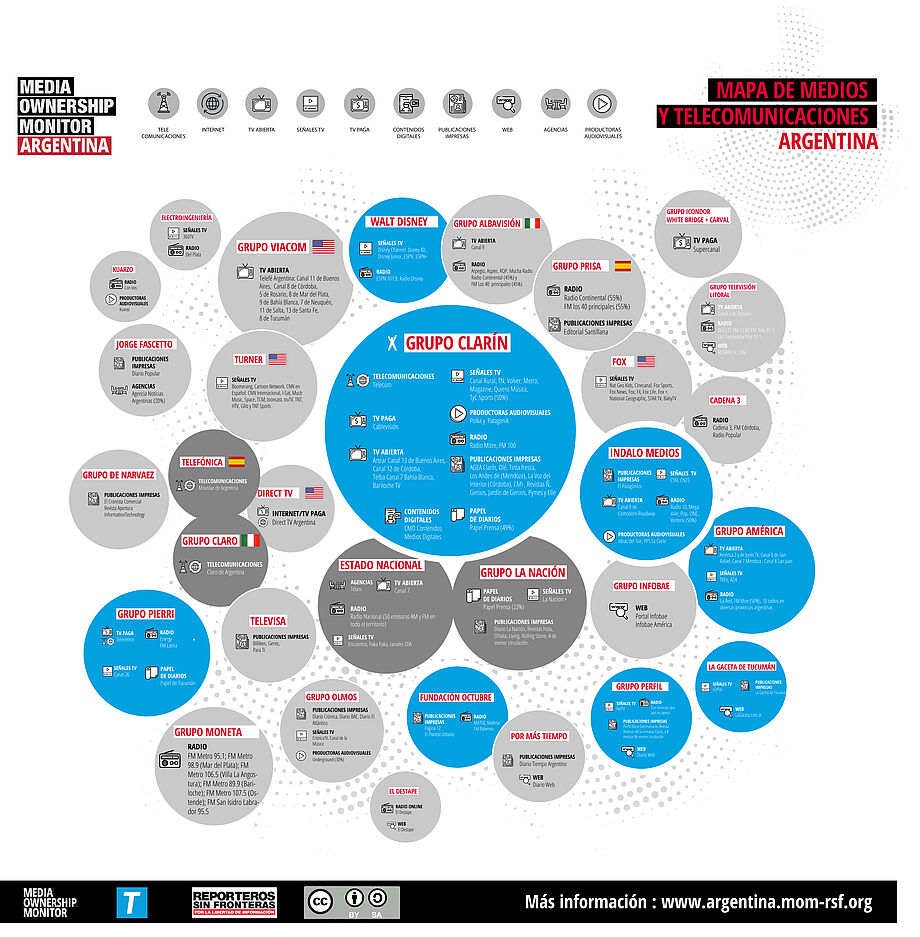

The current media map of Argentina shows high levels of concentration by analyzing the four leading companies in each media segment. However, when considering that many of the leading media groups of one given media type (for instance, online media) are also dominant in the TV, radio and press sector, the level of so-called cross-media concentration is even higher.

Concentration in Argentina is also a geographical issue. Most of the country’s information and entertainment firms are located in the Metropolitan Area of Buenos Aires.

The 22 media groups included in MOM Argentina’s study provide almost 45 million Argentinians with information every day. Political and business connections with media illustrate the close ties the sector has with the country’s economic and political elites.

TV is the most popular news medium in the country, according to the most recent and representative surveys. Only in the Metropolitan Area of Buenos Aires, where ratings are measured, the four leading TV groups (including free and pay TV channels) account for 56.7% of the market. As the content created in Buenos Aires is usually repeated in the interior of Argentina, the four groups’ market share is supposedly even higher at a national level. The main groups that operate in the TV industry are Clarín and Viacom.

Print has lost its direct influence on readership due to a dramatic decline in sales. Nevertheless, it still plays a key role in agenda-setting for radio stations, TV channels and digital news portals, many of which belong to the same media groups. Concentration in print media is higher than in TV. The four leading business groups, to which the highest circulation newspapers belong, account for 74.81% of sales. Grupo Clarín alone covers 43% of the market.

Concentration is also high in radio, a sector that is comprised of a huge number of radio stations thanks to its technological architecture. The four main business groups (the largest being Clarín, Indalo and PRISA/Albavisión) account for 53% of the audience.

In contrast to print, online newspapers are experiencing a surge in visits. The tendency towards concentration in this segment is similar to others, against the popular belief that the internet fosters diversity in the use and consumption of information and therefore democtratizes the design of the public agenda. Although it is impossible to determine the total number of visits of news website and to estimate the percentage of concentration, the more concentrated media companies stand out in rankings that classify websites based on their number of visitors. Among the six informative digital media outlets with the largest audience, four belong to Grupo Clarín: Clarín.com, TN.com.ar, Cien radios and La Voz del Interior.

MOM Argentina’s research includes an indicator that measures cross-media audience concentration. It is a temporary indicator, to be implemented while expecting markets to begin reporting their operations more transparently . Yet, the collected data show that cross-media concentration accounts for 59.24% of total concentration, in the hands of eight leading media groups:

1. Grupo Clarín: 25.28% (6.84% in radio; 10.62% in TV and 7.82% in print)

2. Grupo América: 7.25% (2.27% in radio; 4.09% in TV and 0.89% in print)

3. VIACOM: 7.10% in TV

4. Grupo Indalo: 6.62% (5.12% in radio and 1.5% in TV)

5. PRISA-Albavisión: 6.21% (4.33% in radio and 1.88% in TV)

6. La Nacion: 2.97% in print

7. Cadena 3: 2.6% in radio

8. Federal System of Media and Public Content (SFMyCP, National Government) 1.65% in TV

Grupo Clarín, a symbol of concentration

It is impossible to analyze media concentration and information flows in Argentina without mentioning Grupo Clarín. Clarín was founded in 1945 by Roberto Noble, a politician at the time, growing into other media and industries since the 1980s under the management of the group’s controlling shareholder and CEO, Héctor Magnetto. After the merger of Grupo Clarín’s Cablevisión (the largest cable TV operator) and Telecom (one of the main landline and mobile telephony companies) in 2018, the gap between the conglomerate and the rest of the media has widened in terms of income, audience, geographical scope of the group’s operations and its controlling position in each market. For instance, even without taking into consideration its cable TV, mobile and landline telephony, and internet access operations, Grupo Clarín reported revenues worth $159 million in 2017, while each of its competitors had a turnover below $10 million each. Needless to say, the group’s revenues are considerably higher when including the other business units of the Cablevisión holding.

In addition, Grupo Clarín is the group that benefits the most from official advertising, both from the National Government and the provincial governments.

After Grupo Clarín and Fintech announced their merger in June 2017, the services provided by Cablevisión and Telecom together accounted for 42% of landline services, 34% of mobile, 56% of broadband internet access, 35% of mobile internet access and 40% of pay TV.

The merger constitutes a violation of the law that regulates spectrum (the mobile telephony electromagnetic bandwith). In addition, Cablevisión-Telecom received privileges in the operation of fixed line phone and Internet infrastructure, particularly the communications backbone network in the centre and north part of Argentina – the country’s most populated areas.

Grupo Clarín has been at the center of another merger in the past already: in December 2007, Néstor Kirchner, the President of Argentina at the time, authorized the group's commercial exploitation of the two largest cable operators in the country, Multicanal and Cablevisión.

The recent merger between Cablevisión and Telecom consolidates the communications policy strategy adopted by Mauricio Macri since his coming into power in December 2015. Despite some occasional erratic behavior (it established and then dissolved the Ministry of Communications; it gave benefits to telecoms and cable operators, which it later removed; it failed to fulfill its promise of drafting and presenting an integral bill to Congress on convergent communications), Macri’s administration proved very effective in adapting State regulations and policies to cater to the needs of the largest communication conglomerate in the country.

Grupo Clarín’s growing concentration of media resources, to the disadvantage of other media, has also had a negative impact on the symbolic and economic influence of its competitors. A concern in all sectors of the economy, banned by Article 42 of Argentina’s National Constitution, concentration is particularly detrimental in the information and communication industries. In this regard, international and national case law on freedom of expression defines excessive concentration as a device of indirect censorship that violates the right of freedom of expression and the right of access to culture.

Concentration results in a decrease of information sources (with less plurality of sources), standardizes genres and entertainment formats (thus attacking content diversity), prioritizes certain styles and topics, and reduces the scope of topics and formats.

Besides, media concentration usually leads to a single and prevailing editorial line. It is hard to find truly disagreeing views on sensitive issues within a single media group.

In general, concentration connects show business (exclusive celebrities), sports (purchase of TV rights), the economy (by including financial and banking institutions) and politics (when politicians become media moguls or shareholders in media holdings) with information areas. The implications of these ties impact the autonomy of media outlets eventually.

Another effect of concentration is the geographical centralization of information and content production in the cities where a group’s headquarters are located, a key feature of the Argentinian media system.

In addition, concentration also negatively impacts the labour market and the journalistic profession at large. Some media outlets have been closed down, while others have merged, thus leading to economies of scale, cost savings and layoffs. In addition, within a highly concentrated media system, due to the increasing cartelization of the industry, journalists have very few chances of finding a good job, once they dared to confront any of the leading media groups.

As a result, and with only a few exceptions, concentration processes tend to weaken the free circulation of ideas in a society. For several decades, concentrated actors have played a dominant role in the design of the public policy agenda of the information and communication industries in different countries with different regulatory systems. The updated and comparative documentation presented by MOM Argentina’s research is therefore a major contribution to this debate.